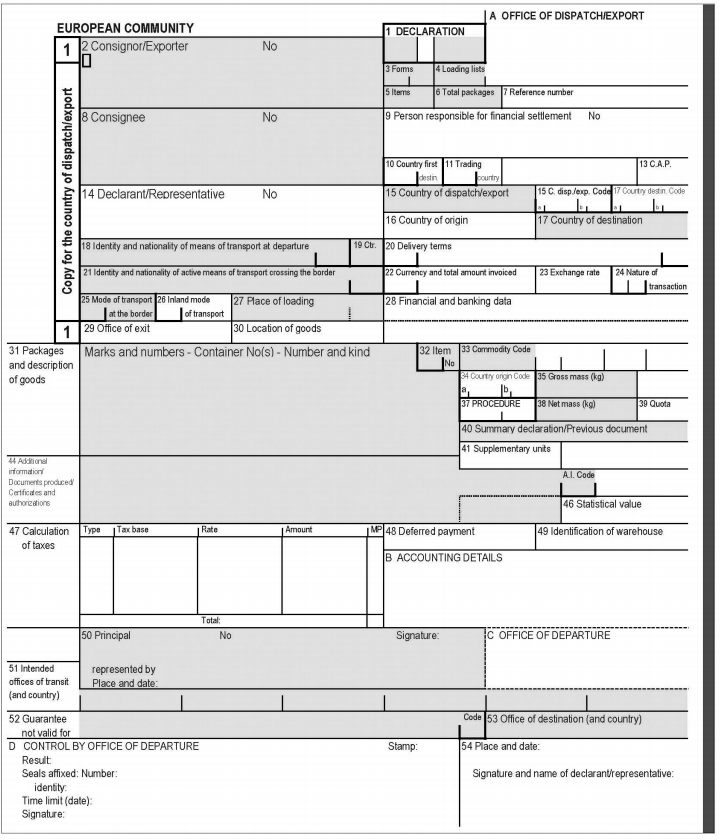

UK Customs Freight Simplified Procedures (CFSP)

Customs Freight Simplified Procedures (CFSP) are specific customs procedures for the import of certain goods into the UK. These include Simplified Frontier Declarations (SFD), Import Supplementary Declarations (SDI), Final Supplementary Declarations (FSD), Warehouse Removal Supplementary Declarations (SDW) and more. Traders who wish to avail of CFSP must apply for authorisation from HMRC. Traders must have…

Details