GB to Northern Ireland Customs

Her Majesty’s Revenue & Customs (HMRC) has finally produced a document that adds clarity to trading procedures between Northern Ireland and the rest of the UK, from January 1st, 2021 onward. In this document released in the last few days, HMRC have pointed out that much of the trade between NI and the rest of…

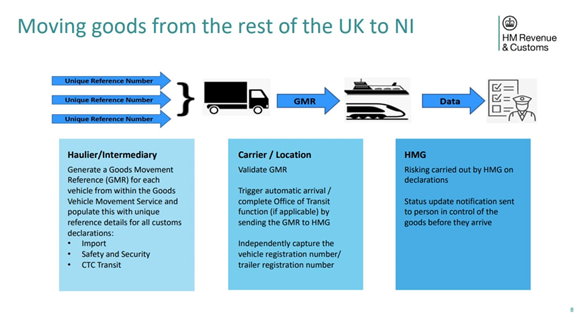

Details