The dual customs plan proposed in the new Brexit deal may suit business and the economy of Northern Ireland even if it does not sit well politically with the unionist community who would prefer to be treated exactly the same as the rest of the UK. To avoid a hard border on the island of Ireland and to uphold the Good Friday agreement something had to give.

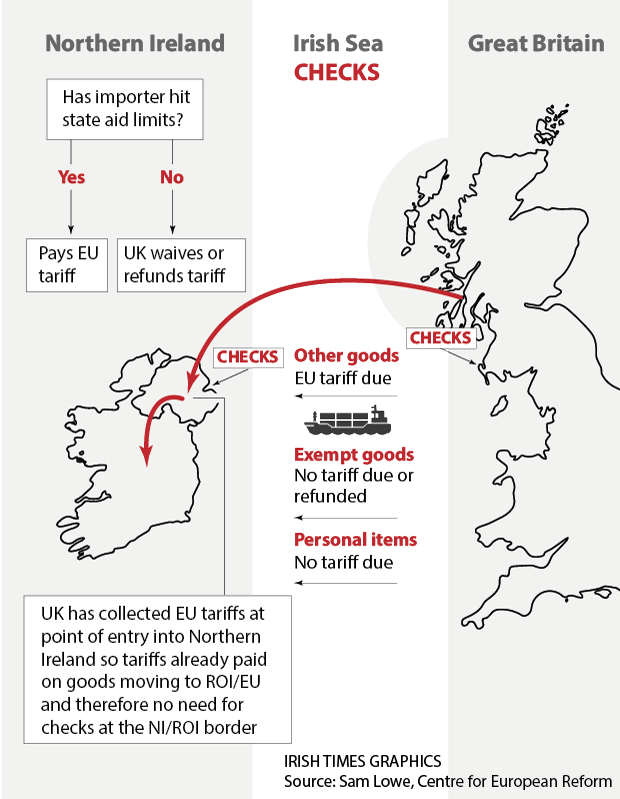

The new dual customs plan would see Northern Ireland stay part of the UK customs territory and under EU customs rules simultaneously. This leaves the border on the island of Ireland open and effectively buts a EU-UK border down the Irish Sea. Customs declarations will be required between Northern Ireland and mainland Britain. Prime Minister Johnson has stated in the House of Commons that no checks will occur between the North and Britain post Brexit.

Northern Ireland could be in a better place economically post-Brexit, as it can take advantage of any free trade agreements the UK makes with non-EU countries such as China or the United States. It may also be in a position to pay a reduced tariff rate on some products as the UK continue to negotiate new trade deals. Getting the deal through the British Parliament is one thing, implementing a workable regime in the future will taking collaboration on all sides.

Here is an example of the proposed dual customs arrangement as published on the IrishTimes Newspaper.

“To understand how this would work, imagine you are a Northern Irish firm importing bolts.

When your bolts arrive in Larne or Belfast, they will be checked and EU tariffs will be applied and collected by the UK and paid on to the EU. That is unless they are personal property and they are a final product and not going to be used in the manufacture of something else.

In addition, EU tariffs could be waived if they meet criteria yet to be determined by a “joint committee” of EU and UK officials who will have to figure this out over a 14-month transition period.

It is presumed that if you can prove the bolts are being sold in Northern Ireland, then you will be able to claim the EU tariff back. If your bolt is exempt under the criteria, it can either enter the North tariff-free from Britain or at the UK tariff for bolts from the rest of the world, presuming it is lower.

Things become complicated if you import your bolts from a country outside the UK or EU and the item is “at risk of subsequently being moved into the [European] Union”. For example, if you are going to use your bolts to make another product, say a train set, in Northern Ireland to be sold on into the EU.“

Dual customs plan – You may also like to read our Customs FAQ where we answer many frequently asked questions about customs declarations.