Her Majesty’s Revenue & Customs (HMRC) has finally produced a document that adds clarity to trading procedures between Northern Ireland and the rest of the UK, from January 1st, 2021 onward. In this document released in the last few days, HMRC have pointed out that much of the trade between NI and the rest of the UK will remain largely unchanged apart from some specific industries and cases. However, trade coming from the rest of the UK to NI will require some extra documentation,and customs declarations.

This is in stark contrast to the assertion made by Boris Johnson when he visited NI last year and told a group of Conservative supporters that there would be “no checks on goods moving between NI and the rest of the UK”. This statement is ambiguous at best and disingenuous at worst. After all, what exact is a check? The British government have committed to not building any extra border infrastructure to facilitate and check trade in and out of NI. What the Prime Minister neglected to mention in his address last year, was the whole area of customs declarations.

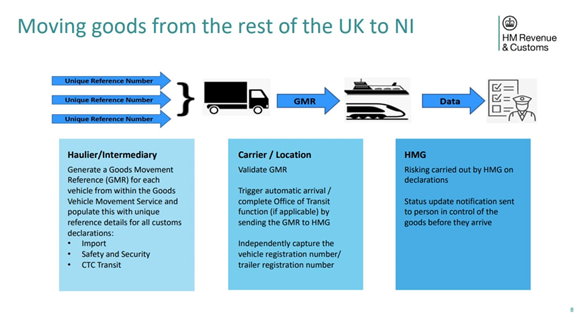

The UK government’s position has changed with last weeks document. Now it is clear that three separate declarations will be required for goods moving from the rest of the UK and NI.

Import – This is the Single Administrative Document (SAD) import. It is required when importing from outside the EU.

Safety & Security – This is an Entry Security Declaration (ENS)and is processed at the first point of entry to the EU when a shipment is moving by sea or air.

CTC Transit – This document is required when goods move back into the EU after transiting through a third country i.e. the UK. Click here for further details on how to fill out a transit declaration.

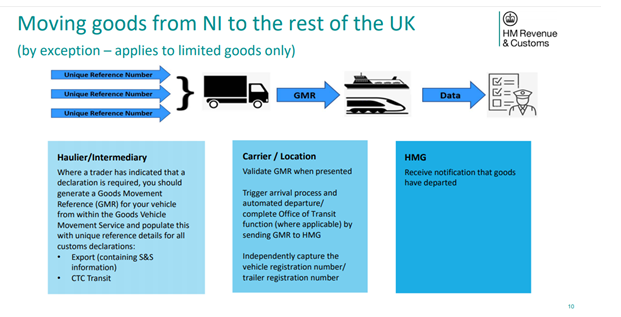

Goods Vehicle Movement Service (GVMS)

The GVMS is a new HMRC system to support the movement of goods between GB and NI post-Brexit. The GVMS is designed to:

- Link together declaration references so that the carrier (e.g. haulier) only has to present one reference (Goods Movement Reference) GMR. before boarding to prove that their goods have submitted declarations to HMRC.

- Link of the movement of the goods to declarations, enabling arrival automation to HMRC. As soon as goods board declarations can be processed en route.

- Automate Office of Transit functionality for transit movements in and out of NI.

- Provide notification of risk of declarations (i.e. cleared or uncleared) in HMRC systems to be sent to the person in control of the goods. When the goods physically arrive, that person knows what to expect in terms of risk, as shipment disembarks.

The clarification from the UK government is welcome but it still means that companies trading between NI and GB have to invest time and money in getting up to speed with customs declaration software. To find out more about your company’s customs compliance obligations contact Custran https://custran.com/