What is a SAD Export Document?

The Single Administrative Document or (SAD) is a standard form used for declaring the export of goods. This declaration has been exclusively submitted to Revenue in Ireland digitally, for the last number of years. In other jurisdictions paper-based SADs can still be submitted to that country’s customs & excise system. This declaration is made either by the trader themselves or by a customs agent on their behalf. When an export declaration is made in the country of export, a corresponding SAD import must be submitted in the country of import. Much of this information will be the same.

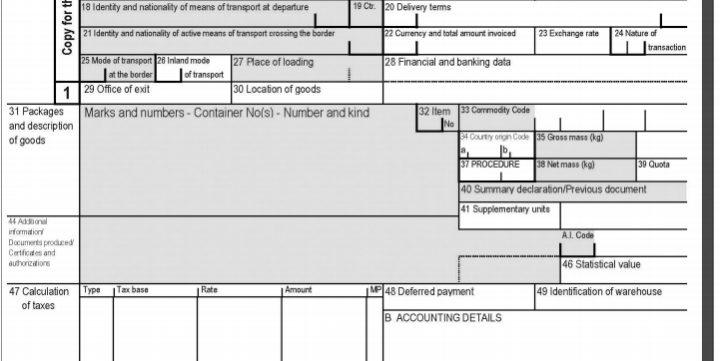

The declarant can access a SAD form on a third party software system that links directly with ROS in Ireland or HMRC in the UK. These SADs consist of 44 boxes and multiple sub boxes. The declarant needs to know consignor, consignee, transport, invoicing, classification and origin details before entering these details on the SAD form. One of the most important aspects of a SAD export to get right, is the classification. The exporter needs to insert the correct commodity code into the SAD export declaration so customs knows exactly what goods are passing through ports. Also the exporter will need to pass this commodity code to the importer, so they can make an import declaration with the correct information. Failure to do this accurately may lead to a shortfall in duties and VAT paid to revenue in the importers jurisdiction.

Revenue uses a traffic light system when designating a routing for your consignment. A green routing means that your goods will be free to enter the port and depart the state without inspection or delay. An orange routing means that you will need to provide supporting documentation directly to the Revenue website in order for your routing to turn green. A red routing means that there will more than likely be a physical check or inspection of your goods at the port before the consignment leaves the state. The routing you are given is dependent on the commodity code entered in the SAD.

Once a green routing is achieved an Export Accompanying Document (EAD) is produced by the software platform you are using. Revenue provides a Movement Reference Number (MRN) on the EAD and displays it to the user. This is usually in pdf format and can be downloaded and emailed to the haulier. The driver will need this to gain entry to the port.

The SAD export form is an internationally recognised customs form and tax document. Declarants need to store all SAD export information securely, as they can be subject to audit from Customs at any point and possibly without notice.

For more information on how to create an Irish Import or Export declaraton contact Custran today – click here